What Is Adverse Media and Why It Matters for Compliance

Adverse media is an essential step in preventing financial crimes and staying compliant for financial institutions and other industries. As regulators ramp up scrutiny and enforcement actions surge worldwide, companies can no longer afford to overlook the reputational and financial risks tied to negative news. In 2026, where digital footprints are wide and public perception is swift, the importance of identifying and acting on adverse media has never been greater.

So, what exactly is adverse media, and why is it crucial for AML compliance and risk management? In this article, we’ll break down its definition, strategic role in compliance workflows, and how organizations can implement robust, real-time screening systems to stay ahead.

What Is Adverse Media?

Adverse media, also known as negative news or adverse news, encompasses any publicly available information that links an individual or organization to potentially illicit or unethical activity. This can range from criminal allegations and fraud to sanctions violations and financial misconduct.

The media sources of adverse media are wide-ranging:

Traditional outlets like newspapers and broadcast media.

Digital platforms such as online news portals, blogs, and watchdog forums.

Public records including court filings, legal databases, and regulatory disclosures.

Leaked documents and whistleblower reports, often disseminated through non-mainstream channels.

What matters isn’t just where the information comes from, but whether it offers actionable intelligence. As such, adverse media or negatives news screening today requires parsing both formal journalism and the fast-moving world of digital media.

Why Adverse Media Screening Is Critical

At the heart of any Anti-Money Laundering (AML) and Know Your Customer (KYC) program lies the goal of understanding and mitigating client risk. A good adverse media screening solution plays a vital role in this process. By uncovering early-warning signals of misconduct or suspicious behavior, screening helps organizations make informed decisions about who they do business with.

Regulatory frameworks such as the FATF Recommendations, EU AML Directives, and FinCEN guidance all underscore the necessity of a risk-based approach, which includes monitoring negative news as part of ongoing due diligence.

And the consequences of non-compliance are no longer abstract:

- In 2024, several global banks faced multi-million dollar fines for failing to detect adverse media linked to sanctioned entities.

- Cryptocurrency platforms have been flagged for onboarding customers implicated in fraud cases reported in foreign-language press.

Ignoring adverse media isn’t just a compliance lapse—it’s a reputational landmine.

Common Adverse Media Screening Challenges

Like any other AML-related process, adverse media screening doesn’t come without challenges. Due to its complexity, many regulated organizations struggle to make screening efficient.

These are the most common pitfalls of adverse media screening:

Long List of Media Sources

A large variety of news sources need to be checked for the most reliable and accurate information. From press releases published by law enforcement agencies to daily news sites, the number of relevant sources can be overwhelming. Many of them are also in different languages, which makes going through all of them, even with good translators, extremely time-consuming and can lead to false positives and false negatives.

Evaluation of Credibility

A large number of media channels poses another challenge, which is assessing credibility. Ensuring that a source is credible and doesn’t include fake news adds more weight to an already heavily tasked process.

Nonspecific Regulatory Requirements

While adverse media searches are compulsory in many regulatory environments, such as the European Union, they are not well specified. The lack of requirements leaves obligated industries puzzled about how to implement adverse media screening correctly and ensure its effectiveness.

How Adverse Media Screening Works

Modern screening systems fall into two broad categories: manual and automated.

Manual methods involve human analysts searching databases and news feeds—a process prone to inconsistency and delay. In contrast, AI-driven platforms leverage natural language processing (NLP) to analyze content in real time, flagging relevant stories based on risk-relevant keywords, entities, and context.

Best-in-class systems integrate directly into onboarding platforms and customer lifecycle tools, allowing for seamless, ongoing monitoring without redundant reviews.

Adverse Media and Enhanced Due Diligence (EDD)

Adverse media isn’t just a checkbox, it’s a trigger for Enhanced Due Diligence (EDD). When negative news surfaces, it can signal a need to deepen investigations into a customer’s background, relationships, or business activity to understand the potential risks.

Common EDD use cases include:

- Politically exposed persons (PEPs) with ties to corruption reports

- High-net-worth clients flagged in international tax evasion scandals

- Crypto investors mentioned in illicit financing investigations

Whether you’re a bank, fintech, or virtual asset service provider (VASP), adverse media can help define the difference between a standard review and a full-scale risk assessment.

Best Practices for Effective Adverse Media Screening

To navigate the complexity of modern media ecosystems, organizations should follow these best practices:

- Use AI and NLP-powered tools that can process vast amounts of multilingual content with high precision

- Implement continuous monitoring rather than one-time checks at onboarding

- Incorporate multilingual and local news coverage to avoid missing critical intel

- Prioritize risk contextually, allowing for alerts to escalate based on severity, geography, or business relevance

A strong screening program isn’t just about detection—it’s about smart, scalable decision-making.

Ondato’s Adverse Media Screening

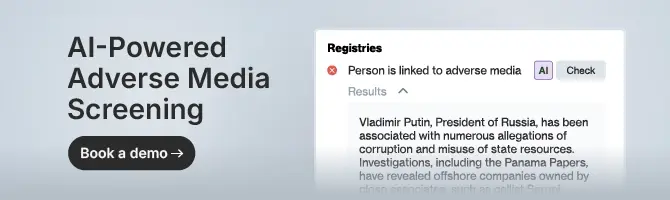

Ondato delivers comprehensive adverse media screening through two powerful layers:

1. Real-Time Checks During IDV

Integrated directly into the identity verification process, Ondato’s AI-powered tool scans global media for reputational risks as part of KYC. It analyzes context, source credibility, and generates concise summaries with risk scores—instantly visible in the Ondato OS dashboard.

2. Continuous Monitoring Post-Onboarding

Beyond onboarding, Ondato performs regular adverse media checks on existing customers, alerting AML teams to new risks in real time. The system supports multi-language sources, automated risk scoring, and customizable workflows for efficient, ongoing compliance.

Together, these tools ensure fast, reliable, and proactive risk detection, at onboarding and beyond.

Final Thoughts on Adverse Media Screening

In a world where reputation can change with a headline, adverse media screening is no longer optional. It’s a critical line of defense, both for meeting regulatory obligations and for protecting your brand.

By adopting advanced tools and implementing best practices, organizations can stay one step ahead of emerging risks, reinforce their AML frameworks, and foster trust in a volatile environment.